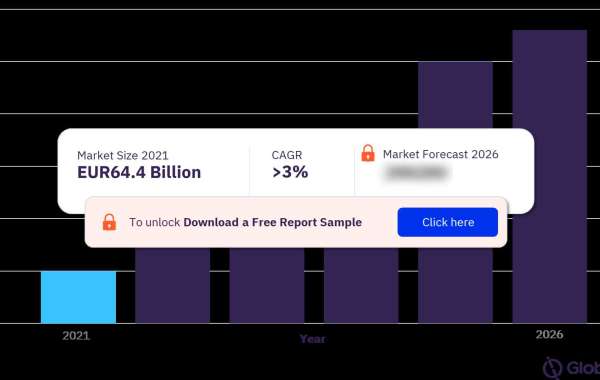

The gross written premium of the Netherlands general insurance market was EUR64.4 billion ($76.2 billion) in 2021 and is expected to achieve a CAGR of more than 3% during 2021-2026. The Netherlands general insurance market research report provides in-depth market analysis, information, and insights into the Netherlands general insurance segment. It also provides values for key performance indicators such as gross written premium, claims, penetration, and premium ceded and cession rates during the review period and forecast period.

For more lines of business insights into the Netherlands general insurance market, download a free report sample

The key lines of business in the Netherlands general insurance market are property, motor, liability, financial lines, MAT, non-life PAH, and miscellaneous. Non-life PAH insurance had the highest market share in the Netherlands general insurance market in 2021.

Non-life PAH Insurance: Non-life PAH insurance was the leading general insurance in 2021. Health insurance premiums increased in 2022, due to rising healthcare sector wages, new and improved medical treatments that are more expensive, and an increase in the aged population in the country.

Motor Insurance: As part of the Dutch Government’s zero-emissions strategy, almost half of all new passenger vehicles will be mandated to be electric by 2025, which will drive the motor insurance growth over the forecast period and also motivate insurers to focus on electric vehicle insurance developments.