Navigating the general insurance market in Belgium can be a complex but rewarding endeavor. Belgium has a well-established insurance sector that offers a wide range of coverage options for individuals and businesses.

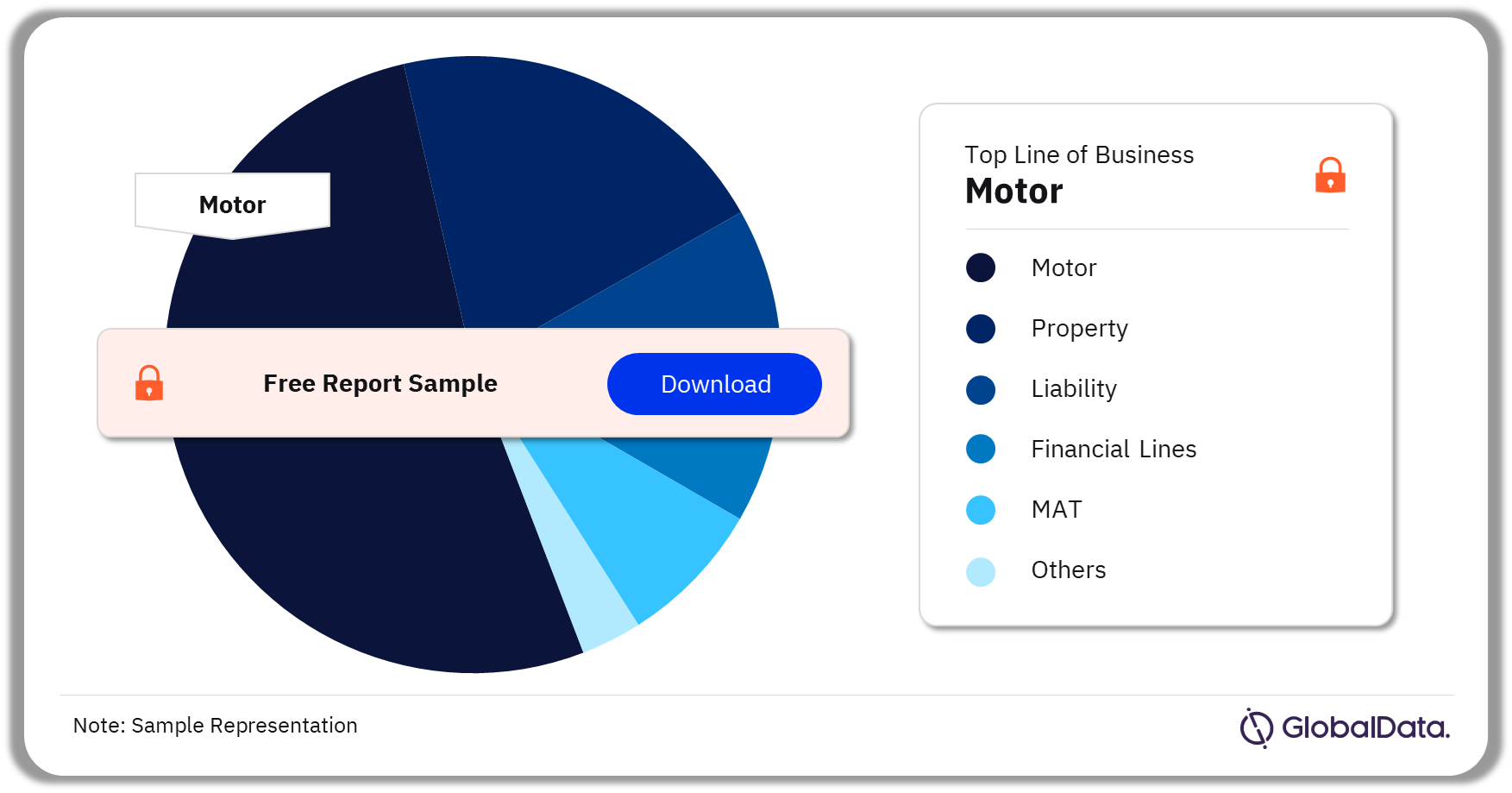

Buy Full Report for More Lines of Business Insights into the Belgium General Insurance Market Download A Free Report Sample

Here's an overview of the general insurance market in Belgium to help you understand the key aspects:

Key Players:

The Belgian general insurance market includes a mix of domestic and international insurance companies. Some of the major players in the market include:

- AG Insurance: One of the largest insurers in Belgium, offering a broad spectrum of general insurance products.

- Ethias: A public insurer, primarily serving the public sector and social economy.

- Belfius Insurance: Offers various insurance solutions and services, often linked to the Belfius bank.

- AXA Belgium: Part of the global AXA Group, providing general insurance products to Belgian customers.

- PV Group: Offers a range of insurance products, including car, home, and liability insurance.

Types of General Insurance:

The general insurance market in Belgium covers a wide array of insurance categories, including but not limited to:

- Car Insurance: Mandatory for all vehicle owners in Belgium, car insurance covers liability and optional coverage like comprehensive and collision.

- Home Insurance: Protects homes and their contents against damage, theft, and other risks.

- Liability Insurance: Includes personal liability insurance, which covers damage you may cause to others, and professional liability insurance for businesses.

- Health Insurance: While healthcare is primarily covered by the government, supplementary health insurance is common for additional coverage.

- Travel Insurance: Offers coverage for travelers, including trip cancellations, medical emergencies, and lost luggage.

- Business Insurance: Covers a wide range of insurance needs for businesses, including property insurance, liability insurance, and business interruption coverage.

Regulatory Environment:

The insurance industry in Belgium is regulated by the National Bank of Belgium (NBB) and the Financial Services and Markets Authority (FSMA). These authorities ensure that insurers comply with solvency requirements, financial stability, and consumer protection.

Consumer Protection:

Belgium has strong consumer protection laws, and this extends to insurance. Insurers are required to provide clear and transparent policy documents, and consumers have the right to cancel insurance policies within a specified period. The regulatory authorities closely monitor market conduct to ensure that consumers are treated fairly.

Challenges:

Regulatory Compliance: Adhering to the regulatory framework, including Solvency II requirements, can be complex and costly for insurers.

Distribution Challenges: Insurers need to adapt to changing distribution channels, including the rise of digital platforms and online aggregators.

Sustainability: Insurers are increasingly focusing on sustainability and addressing climate risks, which can have financial implications.

Cybersecurity: The increasing reliance on technology makes the insurance sector vulnerable to cyber threats. Insurers must invest in cybersecurity measures.

Opportunities:

Innovation: Embracing digital innovation and insurtech can lead to more efficient operations, personalized products, and enhanced customer experiences.

Sustainability: Developing and offering sustainable insurance products can tap into the growing demand for eco-friendly and socially responsible solutions.

Risk Management: There are opportunities in helping individuals and businesses manage evolving risks, including cyber threats and climate-related risks.

Market Expansion: Belgium's central location in Europe makes it a hub for international business. Insurers can tap into cross-border opportunities.

In conclusion, the Belgian general insurance market is characterized by a diverse range of insurance products, strong consumer protection, and a regulatory environment that emphasizes financial stability and solvency. Navigating this market requires a strong commitment to regulatory compliance, a customer-centric approach, and an openness to innovation and sustainability.