The UK SME (Small and Medium-sized Enterprise) insurance market is highly competitive, with several major players and numerous smaller insurers operating in the sector. The dynamics of the market are influenced by various factors, including changing customer needs, regulatory environment, technological advancements, and evolving business risks. In this context, let's discuss the competitor dynamics and opportunities in the UK SME insurance market.

Competitor Dynamics:

Established Insurers: Large, well-established insurance companies such as Aviva, Allianz, AXA, and Zurich have a significant presence in the UK SME insurance market. These companies leverage their brand reputation, extensive distribution networks, and diverse product portfolios to attract customers.

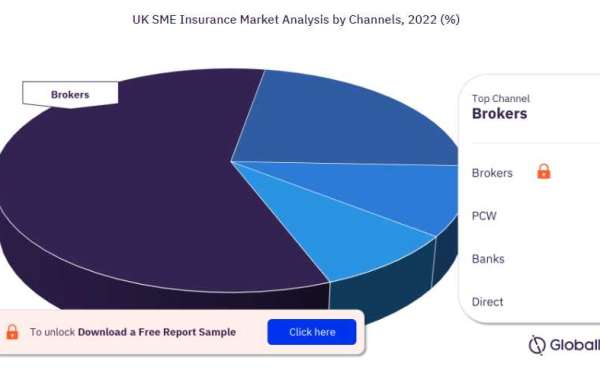

Specialist Insurers: Several specialist insurers focus specifically on SME insurance, offering tailored coverage for specific sectors or industries. For example, Hiscox specializes in providing insurance solutions for professional services, while NIG focuses on commercial insurance for niche sectors like leisure and hospitality. These specialist insurers often differentiate themselves through expertise, industry knowledge, and niche product offerings. For more channel insights into the UK SME insurance market, download a free report sample

Aggregators and Online Platforms: Price comparison websites and online platforms like Simply Business, Constructaquote.com, and Be Wiser Business Insurance have gained popularity in the UK SME insurance market. These platforms allow businesses to compare quotes from multiple insurers and purchase policies online, providing convenience and cost transparency.

Insurtech Startups: The rise of insurtech has brought new entrants into the market, aiming to disrupt traditional insurance models. Startups like Digital Risks, Superscript, and Zego leverage technology, data analytics, and innovative business models to offer flexible and personalized insurance solutions to SMEs. They often focus on specific customer pain points, such as on-demand coverage or usage-based insurance.

Opportunities:

Digital Transformation: The insurance industry, including the SME segment, is undergoing digital transformation. Insurers that invest in technology and provide seamless digital experiences to customers have a competitive advantage. Opportunities exist for insurers to enhance customer engagement, automate underwriting processes, and leverage data analytics for risk assessment and pricing.

Customization and Tailored Solutions: SMEs have diverse insurance needs based on their industry, size, and risk profile. Insurers that can offer flexible, customizable coverage options and tailored solutions to address specific risks have a competitive edge. This could involve creating industry-specific packages, adding optional coverages, or providing risk management services.

Enhanced Customer Experience: Improving the customer experience is crucial in a competitive market. Insurers can differentiate themselves by providing efficient claims handling, responsive customer support, and user-friendly digital platforms. Offering value-added services, such as risk management advice or access to a network of preferred suppliers, can also enhance the customer experience.

Innovative Product Offerings: As business risks evolve, insurers can identify emerging risks and develop innovative insurance products to address them. Examples include cyber insurance, product liability coverage for emerging technologies, and coverage for the sharing economy. Identifying and addressing these emerging risks can provide opportunities for insurers to differentiate themselves in the market.

Partnerships and Distribution Channels: Collaborations between insurers, brokers, and other industry stakeholders can help reach SME customers effectively. Partnering with industry associations, trade bodies, or technology platforms can provide access to a wider customer base. Insurers can also explore alternative distribution channels, such as affinity partnerships or embedding insurance within other business services.

It's worth noting that the competitive landscape and opportunities in the UK SME insurance market can change rapidly due to evolving market conditions and regulatory developments. Insurers need to stay agile, monitor industry trends, and adapt their strategies accordingly to succeed in this dynamic market.