The cards and payments market in Vietnam has witnessed significant growth over the years, driven by various factors such as increasing digitalization, rising disposable income, and a growing middle-class population. This article provides an overview of the Vietnam cards and payments market and highlights the key trends and opportunities in the industry.

The Vietnam cards and payments market has experienced significant growth in recent years, driven by technological advancements and changing consumer behavior. The market is characterized by the increasing adoption of digital payment methods, including e-commerce, mobile payments, and contactless payments. Government initiatives and the presence of key players in the market have also contributed to its growth. Despite the challenges faced by the industry, such as security concerns and limited financial inclusion, the future outlook for the Vietnam cards and payments market remains positive.

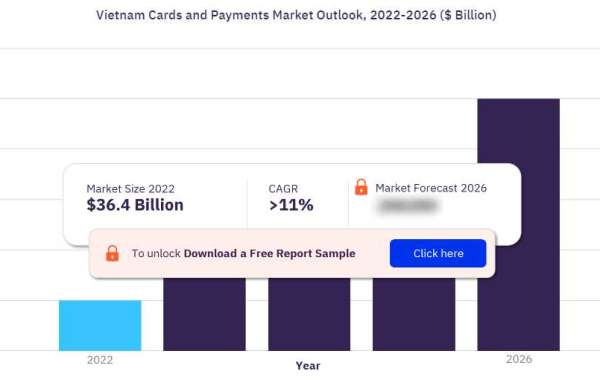

To gain more information on the Vietnam cards and payments market forecast, download a free report sample

Market Overview

Vietnam's cards and payments market has been growing steadily, fueled by factors such as economic development, urbanization, and the government's push for digitalization. The market comprises various payment instruments, including debit cards, credit cards, prepaid cards, and others. With a large unbanked population, there is immense potential for the expansion of financial services in the country.

Payment Instruments

The cards and payments market in Vietnam is dominated by debit cards, which are widely used for everyday transactions. However, the popularity of credit cards is also increasing, driven by the rising middle-class population and changing consumer preferences. Prepaid cards, on the other hand, are gaining traction for their convenience and ease of use.

E-commerce and Online Payments

E-commerce has been rapidly growing in Vietnam, driven by increased internet penetration and smartphone usage. Consumers are increasingly turning to online platforms for shopping, leading to a surge in online payments. Digital wallets and online payment gateways have become popular methods for making secure and convenient online transactions.

Mobile Payments

Mobile payments have gained significant popularity in Vietnam, with a growing number of people using smartphones for various financial transactions. Mobile wallets and payment apps have simplified the process of making payments, enabling users to transfer funds, pay bills, and make purchases with just a few taps on their mobile devices.

Contactless Payments

Contactless payments are becoming increasingly prevalent in Vietnam, providing a faster and more convenient way to make transactions. Contactless payment cards and mobile payment solutions using near-field communication (NFC) technology are being widely adopted by both merchants and consumers.

Government Initiatives

The Vietnamese government has taken several initiatives to promote digital payments and financial inclusion. The State Bank of Vietnam has implemented regulations and policies to encourage the adoption of electronic payment systems, enhance security measures, and protect consumers' interests. These initiatives aim to create a robust and efficient payments ecosystem in the country.

Key Players

The Vietnam cards and payments market is highly competitive, with both domestic and international players operating in the industry. Major players include banks, fintech companies, payment service providers, and e-commerce platforms. These players are continually innovating to provide secure and user-friendly payment solutions to meet the evolving needs of consumers and businesses.

Challenges and Opportunities

While the Vietnam cards and payments market presents significant opportunities, it also faces certain challenges. Security concerns, including fraud and data breaches, pose a risk to the adoption of digital payment methods. Additionally, financial literacy and limited access to banking services remain obstacles to financial inclusion. However, the growing middle-class population, increasing smartphone penetration, and supportive government policies provide a favorable environment for the expansion of the cards and payments market.

Future Outlook

The future outlook for the Vietnam cards and payments market is promising. Technological advancements, including the adoption of artificial intelligence and blockchain technology, will further enhance the security and efficiency of payment systems. The increasing collaboration between financial institutions, fintech companies, and e-commerce platforms will drive innovation and improve the overall customer experience. As digitalization continues to accelerate, the cards and payments market in Vietnam is poised for sustained growth in the coming years.

The Vietnam cards and payments market is undergoing a transformative phase, driven by digitalization and changing consumer preferences. The adoption of e-commerce, mobile payments, and contactless payments is reshaping the payments landscape in the country. With supportive government initiatives and the presence of key players, the market is expected to experience significant growth in the coming years. However, addressing security concerns and improving financial literacy will be crucial to ensuring the continued success of the industry.