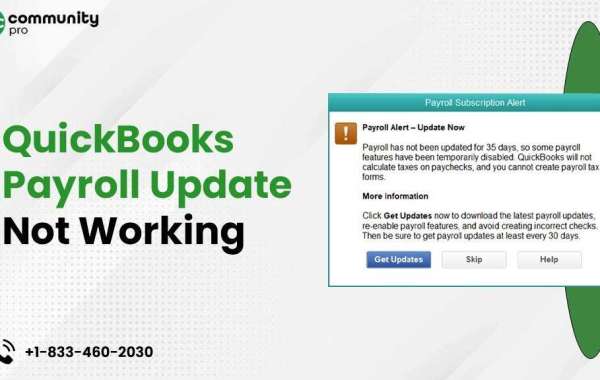

QuickBooks Payroll is a valuable feature within the popular accounting software, QuickBooks, that streamlines payroll processing for businesses. However, users may encounter issues where QuickBooks Payroll does not update correctly. This article addresses the possible reasons behind this problem, provides solutions to resolve it, and explores the benefits of seeking QuickBooks Payroll support for efficient troubleshooting.

Section 1: Understanding QuickBooks Payroll Not Updating

QuickBooks Payroll not updating is a common concern faced by users when attempting to update their payroll tax tables, forms, or software version. This issue can hinder smooth payroll operations, resulting in inaccuracies in employee payments and compliance-related problems.

Section 2: Causes of QuickBooks Payroll Not Updating

a. Internet Connectivity Issues:

Poor or unstable internet connections can prevent QuickBooks from establishing a secure connection to the Intuit servers, leading to update failures.

b. Firewall or Antivirus Interference:

Overly strict firewall or antivirus settings may block QuickBooks from accessing the necessary resources online for updates.

c. Outdated QuickBooks Version:

Running an outdated version of QuickBooks may result in compatibility issues when trying to update the payroll features.

d. Corrupted Payroll Tax Table Files:

Damaged or corrupted tax table files can impede the update process and cause errors.

e. Incomplete Installation:

If the QuickBooks Payroll feature was not installed correctly, updates may not apply successfully.

Section 3: Solutions to QuickBooks Payroll Not Updating

a. Check Internet Connectivity:

Ensure that your internet connection is stable and capable of establishing a secure connection to Intuit servers. Restart your modem and router if necessary.

b. Adjust Firewall and Antivirus Settings:

Temporarily disable your firewall and antivirus software to see if they are causing the update issue. If the update is successful, reconfigure these security settings to allow QuickBooks access.

c. Update QuickBooks:

Verify that you are using the latest version of QuickBooks. If not, update the software to eliminate compatibility problems.

d. Reset QuickBooks Update:

In QuickBooks, navigate to "Help" "Update QuickBooks" "Options" "Reset Update." Restart QuickBooks and attempt the update again.

e. Verify Payroll Tax Table Files:

Run the "Verify Data" utility to check for any issues with payroll tax table files. If any problems are detected, follow the on-screen instructions to resolve them.

f. Repair QuickBooks Installation:

If QuickBooks Payroll was not installed correctly, repair the installation through the Control Panel (Windows) or by using the QuickBooks Install Diagnostic Tool.

Section 4: The Benefits of Seeking QuickBooks Payroll Support

a. Expert Assistance:

QuickBooks Payroll support provides access to certified experts who are well-versed in resolving payroll-related issues. They can diagnose the problem efficiently and provide tailored solutions.

b. Time-Saving:

By seeking professional support, users can save valuable time that would otherwise be spent troubleshooting on their own.

c. Avoiding Data Loss:

Incorrectly attempting to fix the issue can lead to data loss or further complications. With expert support, the risk of data loss is minimized.

d. Improved Payroll Accuracy:

QuickBooks Payroll support can help ensure that your payroll tax tables are up-to-date, enhancing the accuracy of employee payments and tax calculations.

e. Compliance Assurance:

Payroll experts can guide users on how to stay compliant with ever-changing tax laws and regulations.

Conclusion

QuickBooks Payroll not updating can disrupt payroll operations and create discrepancies in employee payments. By understanding the potential causes of this issue and applying the appropriate solutions, users can resolve the problem effectively. Seeking QuickBooks Payroll support offers the added advantage of expert assistance, ensuring smooth payroll processing and compliance adherence. As a result, businesses can focus on core operations, knowing that their payroll system is functioning accurately and efficiently.